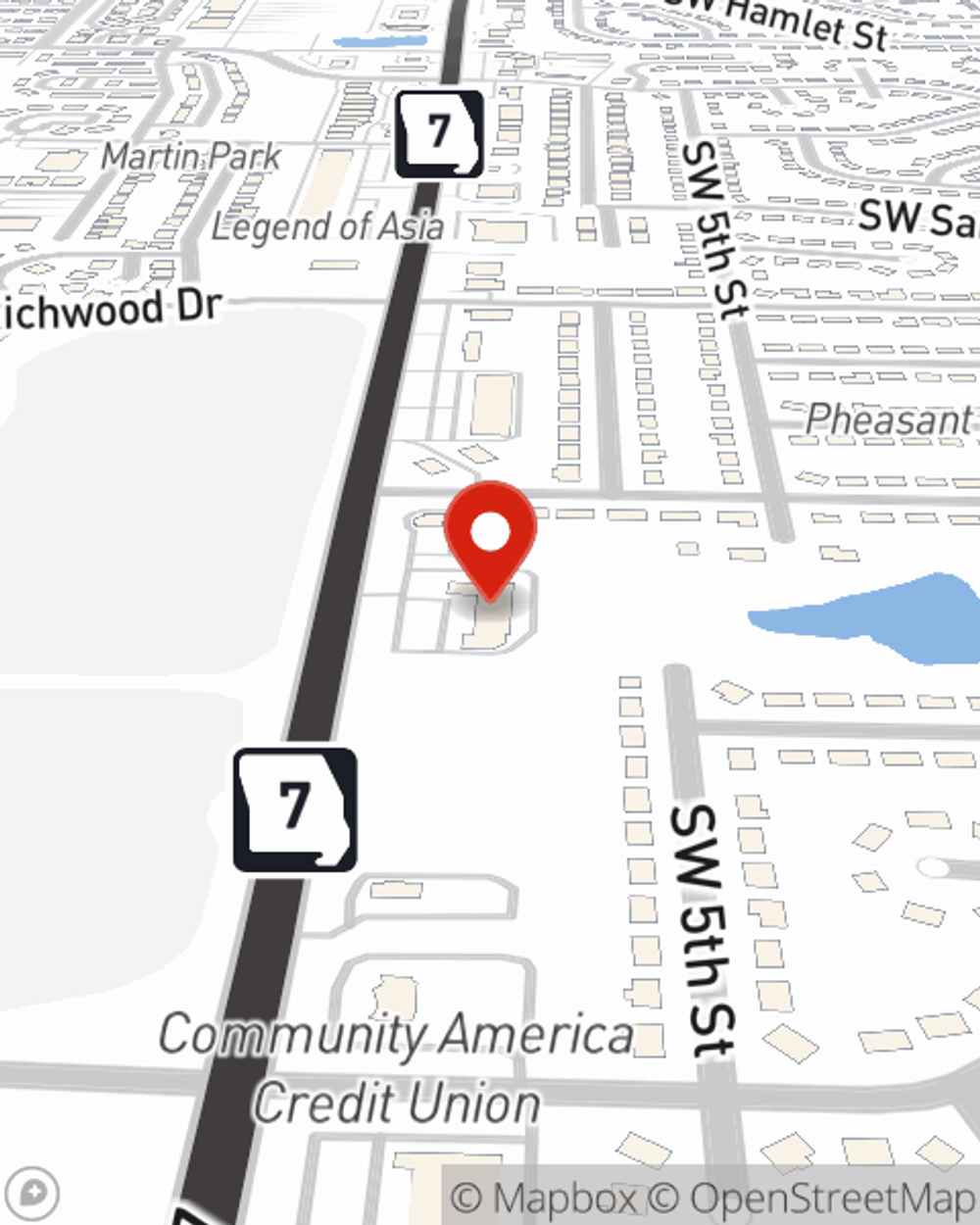

Condo Insurance in and around Blue Springs

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Your Search For Condo Insurance Ends With State Farm

Looking for a policy that can help insure both your condo and the sound equipment, home gadgets, souvenirs? State Farm offers remarkable coverage options you don't want to miss.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Protect Your Home Sweet Home

When a blizzard, a hailstorm or theft cause unexpected damage to your townhome or someone slips on your property, having the right coverage is vital. That's why State Farm offers such terrific condo unitowners insurance.

Intrigued? Agent Steve Shipman can help you understand your options so you can choose the right level of coverage. Simply stop by today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Steve at (816) 228-6696 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Steve Shipman

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.